Contracts for Difference, or CFDs , have gained popularity among traders and investors as a flexible and accessible way to participate in financial markets. This guide aims to provide a thorough overview of CFDs, their mechanics, and key considerations for those interested in trading these instruments.

What are CFDs?

CFDs are derivative products that allow traders to speculate on the price movement of various financial assets, such as stocks, indices, commodities, and currencies, without owning the underlying asset. When trading CFDs, you enter into an agreement with a broker to exchange the difference in the price of an asset from the point at which the contract is opened to when it is closed.

How do CFDs work?

When trading CFDs, you can take either a long (buy) or short (sell) position, depending on whether you expect the price of the underlying asset to rise or fall. If your prediction is correct, you will make a profit; if not, you will incur a loss. The profit or loss is determined by the difference between the opening and closing prices of the contract, multiplied by the number of units traded.

One of the key features of CFDs is the use of leverage. Leverage allows traders to gain exposure to larger positions with a smaller initial investment. However, it’s essential to note that while leverage can amplify potential profits, it can also magnify losses.

Advantages of trading CFDs

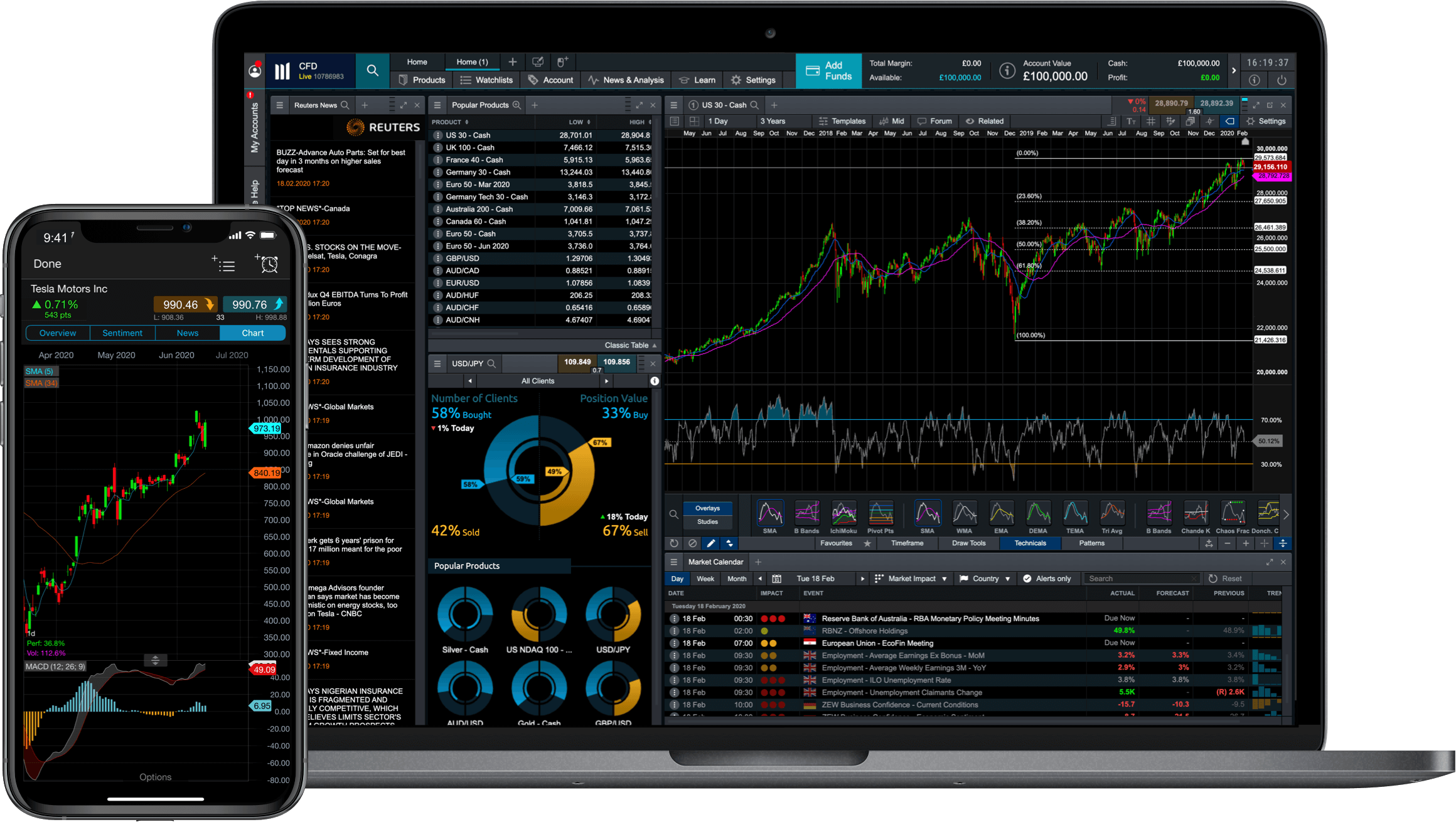

Market access: CFDs enable traders to access a wide range of markets from a single platform, including stocks, indices, commodities, and currencies.

Flexibility: CFDs offer the ability to trade on both rising and falling markets, allowing traders to potentially profit in various market conditions.

Cost-effectiveness: CFDs often have lower transaction costs compared to traditional trading methods, as there are no ownership transfer fees or stamp duties.

Leverage: CFDs offer flexible leverage, which can help traders increase their exposure and potential returns.

Risks associated with CFD trading

Market risk: The value of CFDs is directly linked to the price of the underlying asset, and adverse market movements can result in significant losses.

Leverage risk: While leverage can amplify potential profits, it can also magnify losses if the market moves against your position.

Counterparty risk: CFDs are traded through a broker, and there is a risk that the counterparty may default on their obligations.

Lack of ownership: As CFDs do not involve owning the underlying asset, traders do not have voting rights or receive dividends.

Before trading CFDs, it’s crucial to understand the risks involved and ensure that you have a solid grasp of the market and the instruments you’re trading. Always consider your risk tolerance, financial goals, and level of experience when making trading decisions.

In conclusion, CFDs can be a valuable tool for traders looking to diversify their portfolios and access a wide range of markets. By understanding the mechanics, advantages, and risks associated with CFDs, traders can make informed decisions and develop effective trading strategies.